Archive for the ‘cooley llp’ tag

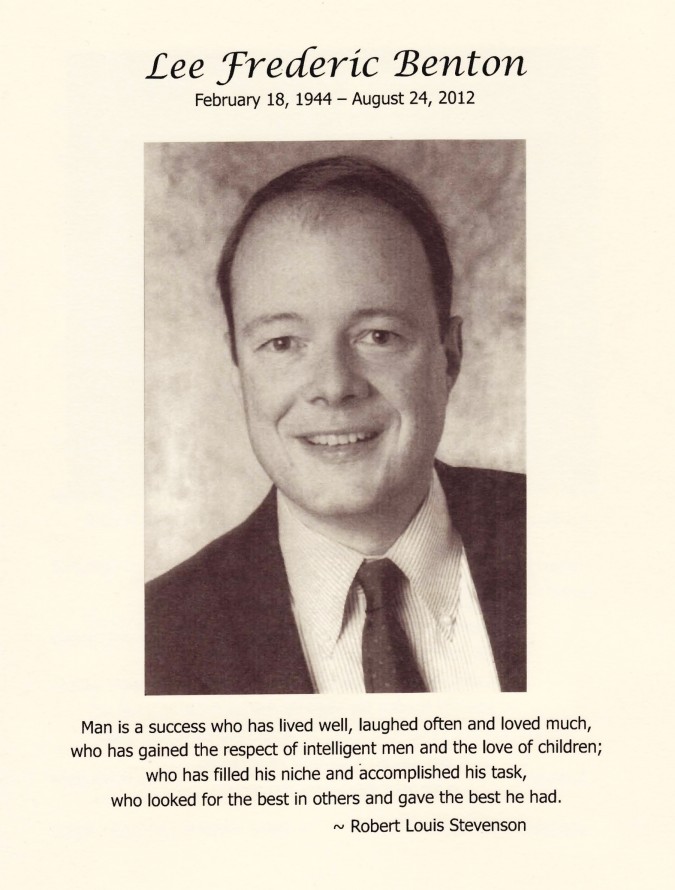

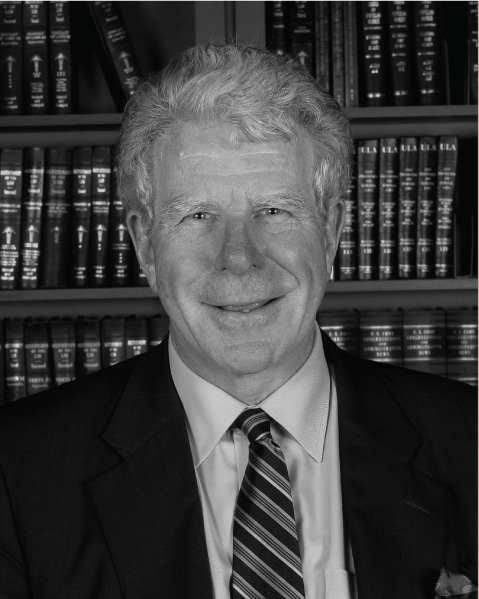

Memorial service for Lee Frederic Benton, October 6, 2012

My birthday was yesterday, October 6, 2012.

I will long remember this birthday because I attended the memorial service for Lee Frederic Benton, held at Holy Trinity Church, 330 Ravenswood Avenue, Menlo Park, California, USA.

Benton was born February 18, 1944 and passed away unexpectedly August 24, 2012.

I did not know Mr. Benton well, but he played a major part in my life. I was able in 2007 to tell him the facts that lead to this conclusion, but, sadly, I don’t believe I thanked him for his pivotal contribution to my success in life. Thank you Lee Benton.

In about 1991 I went to the offices of Analytic Legal Programs, Inc., founded by Eric Little. Analytic Legal Programs made a document assembly software program called WorkForm. At the time, I worked at Cooley, LLP, then named Cooley Godward Castro Huddleson & Tatum. Cooley had purchased a firm wide license for WorkForm, and had asked me to lead the project. Associate attorney Jeff Zimman was to program the first set of documents, a set of 17 documents to incorporate a company in California.

Since neither of us knew the WorkForm software, we both attended a several day training session at the offices of Analytic Legal Programs in Palo Alto, California USA.

Zimman left a voice mail for Benton during our training, and the subject was Zimman’s compensation at Cooley. From that I have guessed Benton supervised Zimman, and gave Zimman his assignments. I have further guessed that Benton authorized Zimman to spend the hundreds of non-billable hours that he would eventually dedicate to the document assembly project. Without Zimman, there would have been no document assembly project, because Zimman was the only attorney at Cooley that showed any interest in document assembly back then. Without Benton letting Zimman stop billing hours to clients for a time, there also would have been no document assembly at Cooley. As a result, without Benton, I would have never become an expert at document assembly, and I would thus have not started Hotpaper.com, Inc., the first Internet document assembly platform, in 1995. Had I not started Hotpaper, I would not have sold it in 2000, and I would not have been able to buy the house I am typing this post in, or to live my life I treasure so much that I write about on this blog.

Starting an Internet company that gets acquired is very difficult. I needed every advantage along the way to get to where I am today, and Lee Benton gave me a huge advantage. He freed up hundreds of hours of time of a rising star attorney, which ended up launching my career in high technology. I simply don’t think I would have gotten into the Internet business had it not been for Lee Benton and Jeff Zimman.

When I was at Cooley, Benton had not yet led the entire firm, but I knew that he would, because Helen Gaffney, since passed, told me so. Gaffney ran the firm’s Information Technology infrastructure at the time she said this, about half a decade before Benton became Managing Partner, the title the firm then used for its top leader. The firm now uses the title CEO for its top leader, and I learned yesterday that Cooley’s current CEO Joe Conroy, joined Cooley while Benton was Managing Partner, and that Conroy greatly admired Benton. Conroy attended Benton’s memorial yesterday, but I did not see him.

Lee Benton’s memorial service was very touching to me. I recognized some of the attorneys that were at Cooley when I left in 1994, including Frederick Baron, Pam Martinson, Alan Mendelson, Gordon Atkinson, Kenn Geurnsey, Paul Renne, James Gaither, Craig Dauchy and my own current attorney Eric Jensen. That this group attended was amazing to me, because I actually received material help on my project in the 1990s from Baron, Martinson, Mendelson, Guernsey, Renne and Jensen. I hadn’t seen Martinson, Dauchy, Atkinson or Gaither since 1994, but I recognized all of them, and they appeared to recognize and remember me when I greeted them. Sadly, Martinson and Mendelson left before I got to say hello to them. I most recently saw Mendelson by chance at Nordstrom in 2008 when I was trying on tuxedos for my wedding.

My friend Tom Kintner was also there, and I learned Kintner worked with Benton and others on the USD $621 book Venture Capital & Public Offering Negotiation. ‘This book is the leading authority on the legal aspects of venture capital funds and of private financing and initial public offerings for technology companies,’ per Cooley’s website. I have known Kintner for over a decade, and I never knew he knew Lee Benton until yesterday.

When I said hello to Paul Renne, I had the great pleasure of meeting his wife, former San Francisco City Attorney Louise Renne.

Benton was revered when I was at Cooley, and although I only spoke with him perhaps half a dozen times in the five years I worked at Cooley, I always knew he was extremely influential. I once had to modify the California Incorporation document set to incorporate his changes, and I vividly remember thinking at the time that they were the most impressive set of edits I had yet seen from any attorney. Even though I am not and have never been an attorney, I had by then developed an ability to identify precise and impressive edits, and Benton’s were outstanding. His dozens of edits made the documents more conclusive without being stern.

Frederick Baron spoke at the memorial. His written remarks were poignant and lovely — so much so that I suggested he post them online for posterity. If he finds this post and thinks this is a suitable place for his remarks to live on, I invite him to forward them to me for incorporation into this post, which I am happy to revise.

One of the stories Baron relayed was so sweet that I am going to relay it here.

Baron told the story of how he arrived at Cooley. He moved to the San Francisco Bay Area and knew of Lee Benton’s stature. He heard Cooley had just opened an office in Palo Alto, its first branch office. The firm was founded in San Francisco. Lee Benton was part of the first group of Cooley attorneys that opened the Palo Alto office. Baron applied to Cooley and got an interview with Benton himself. The story takes a charming turn when Baron told us yesterday that his son, age 4 at the time, rode in a car pool to school starting the day before Baron’s interview with Benton. Using more descriptive language than I will here, Baron described his 4 year old son as a boisterous handful. Baron was alarmed when he learned the night before his big interview with Benton that the driver of his child’s car pool was Lee Benton himself.

As you can guess, the interview went well and Baron was hired despite his fears that his rambunctious son might have harmed his chances. Frederick Baron went on to lead a department for decades.

Baron and Benton and their wives all became dear friends.

One of Lee Benton’s clients, Bob Plaschke, also spoke. He told a series of stories that elicited hearty laughs from the audience. He also spoke affectionately about Benton’s laugh, which he described as infectious, distinctive and highly memorable. I never heard Benton laugh because in total I probably spent no more than 30 minutes speaking with him, the most recent 10 minutes at a party at Cooley in 2007, when I got to have a very nice conversation with him despite the absence of laughing.

Plaschke told a great story about when one of his companies was doing a closing for a transaction. The closing happened on a weekend, and Benton dropped by the Cooley office where other attorneys were completing the work. However, Benton wanted to pitch in and help, and he asked a young associate how he could contribute. Plaschke said this young female associate tried meekly to decline Benton’s offer, but Benton persisted. Finally, using her hands that were trembling with fear, she handed a document she had written to Benton and asked him if he would review it for her. Benton enthusiastically attacked the document with his red pen, and when complete, there was red ink on every line of the four pages. Plaschke said Benton was so pleased to be able to help, and that he saw Benton commend the young associate on how well she had handled the delicate representations and warranties section.

This is such touching story for me, so much that it brought tears to my eyes as I wrote it. Benton clearly didn’t even need to be at the office for the closing, since there were others there already handing things. But Benton cared for his client’s interests, and wanted to make sure things were OK. He insisted on helping, and used the opportunity to do well for his client and to help train a young attorney, who no doubt remembers that weekend encounter with Benton.

We are all here on Earth for such a short time. How well we treat others defines how we will be remembered. How we treat those far below us in rank particularly defines how we will be remembered. All of the speakers yesterday conveyed that Lee Benton was an exceptionally kind, humble and conscientious man. He got a lot done in life while warming the hearts of those around him. Many others get a lot done while trampling over people without remorse. I consider Lee’s approach by far to be the gold standard for how to live.

Thank you Lee Benton for all that you accomplished and all the love that you extended during your exceptional time on Earth.

Here is the obituary for Lee Frederic Benton, as published in the San Francisco Chronicle newspaper on September 9, 2012:

Lee Frederic Benton

Lee Benton passed away in Palo Alto on August 24, 2012 at the age of 68 due to complications following surgery.

Born on February 18, 1944 in Springfield, Ohio, Lee was the son of the late Robert and Candice Collins Benton. He was a graduate of Oberlin College and received his J.D. from The University of Chicago, where he served as the Executive Editor of The University of Chicago Law Review. Lee was a teaching fellow at Stanford Law School before joining the San Francisco office of Cooley, LLP in 1970.

Lee was a founder of Cooley’s Palo Alto office in 1980 and was managing partner from 1996 to 2001. He was a partner at the firm from 1975 until 2006 and then served as senior counsel. During his distinguished legal career he focused on the formation, financing and growth of high technology companies. While at Cooley he also served as general counsel and a member of the senior management teams of two publicly traded technology companies.

In addition to being an accomplished practitioner, he was a dedicated mentor to a generation of lawyers who value his legacy. Reflecting on what Lee stood for in his life and work, one colleague wrote, “success does not have to come at the expense of decency and humanity or be coupled with the sacrifice of principle or soul.”

Lee was a deeply thoughtful, kind, and caring man. In recent years he faced several health challenges with an indomitable spirit. Drawing from these experiences and the expertise he acquired, he was tireless in extending his help to individuals and institutions. He served on the Board of Directors of the National Headache Foundation, as a Strategic Advisor to the California Institute for Quantitative Biosciences (QB3).

He took great pleasure in his unique array of hobbies. Some of his extensive collections and research included commercial aviation, single malt scotch, classical music, and country music. He was, as well, an avid and vocal follower of sports and politics.

Lee was a loving husband and father and is survived by his wife Susan, sons Timothy and Matthew, brothers Marc (wife Trish) and Bruce (wife Andrea), and brother-in-law David Wann.

On Saturday, October 6 at 1:00 pm, a memorial service to celebrate Lee’s life will be held at Trinity Church, 330 Ravenswood Ave., Menlo Park. For contributions in his memory, the family suggests the National Headache Foundation, 820 N. Orleans, Suite 411, Chicago, IL 60610.

Here is the August 27, 2012 press release from Cooley’s website:

We are saddened to announce that Cooley former Managing Partner and long-time colleague Lee F. Benton passed away last week.

Lee began his career at Cooley in 1970, and was a partner of the firm for more than 30 years. He served as Chair of the Business Department from 1994 to 1996, and was the Managing Partner of Cooley from 1996 to 2001. At the time of his death, Lee was Senior Counsel to the firm.

In addition to his formal leadership roles, Lee played a significant part in establishing Cooley as one of Silicon Valley’s most respected and important law firms. Lee was among the first of our lawyers to move from San Francisco to Palo Alto to open our first office there in 1980.

Lee was a brilliant practitioner and a highly regarded speaker on the topics of securities law, venture capital, mergers and acquisitions and strategic partnering. He took immense pride in his work and was a great teacher of generations of Cooley lawyers. He devoted himself to the success of his clients, even serving as general counsel and a member of the senior management teams of two publicly traded technology companies. Lee also served on a volunteer basis as Strategic Advisor to the California Institute for Quantitative Biosciences (QB3) and on the Boards of Directors of Sonim Technologies, Inc. and the National Headache Foundation.

Lee was truly instrumental in building the firm we are today. His legacy will be a lasting one and he will be deeply missed.

Our thoughts and prayers are with his wife Susan and their family during this difficult time.

Here is Lee Benton’s biography from Cooley’s website, as of October 7, 2012

Lee F. Benton was a partner in the firm from 1975 until 2006, and then served as senior counsel in the Securities Regulation group until his death in 2012. He was the managing partner of the firm from 1996 to 2001 and chair of the firm’s business department from 1994 to 1996. He commenced his career in Cooley’s San Francisco office in 1970 and founded the firm’s Palo Alto office in 1980. He is listed in The Best Lawyers in America, in “The Best Lawyers in Silicon Valley” in San Jose Magazine, in Marquis Who’s Who in America and in Madison Who’s Who in the World.

Mr. Benton’s practice encompassed a broad spectrum of fields related to the formation, financing and growth of high technology companies. He represented high technology firms from their inception through maturity as publicly-traded corporations. Mr. Benton also represented a large number of venture capital firms. His particular areas of expertise included strategic partnerships, equity incentives, initial public offerings, securities law, mergers and acquisitions, and cross-border transactions.

While at the Firm, Mr. Benton also served as general counsel and a member of the senior management teams of two publicly-traded technology companies.

Mr. Benton was the executive editor of The University of Chicago Law Review from 1968 to 1969 and a teaching fellow at Stanford Law School from 1969 to 1970. Mr. Benton authored numerous articles and lectured extensively for the Practicing Law Institute, California Continuing Education of the Bar and Aspen Law and Business Inc. His topics included securities law, venture capital, M&A and strategic partnering. He is a co-editor and co-author of Venture Capital and Public Offering Negotiation (Aspen Law and Business, Inc., 2002). This book is the leading authority on the legal aspects of venture capital funds and of private financing and initial public offerings for technology companies.

Mr. Benton served on a volunteer basis as a strategic advisor to the California Institute for Quantitative Biosciences (QB3) and on the boards of directors of Sonim Technologies, Inc. and the National Headache Foundation.

Education

- University of Chicago Law School

JD, 1969, Order of the Coif - Oberlin College

BA Government, 1966, magna cum laude

Admissions

- California

Memberships

- American Bar Association

Here is Lee Benton’s obituary published August 28, 2012 in The Recorder newspaper (link):

SAN FRANCISCO — Lee Benton, a former managing partner of Cooley during the heady years of the dot-com boom, died Friday due to complications following surgery. He was 68.

Benton had been with the firm for more than 30 years and held several top leadership positions. He chaired Cooley’s business department from 1994 to 1996 and served as managing partner from 1996 to 2001. He was senior counsel at the time of his death.

Benton was a dedicated, meticulous and well-respected attorney who played a key role in establishing and building Cooley’s presence and reputation in Silicon Valley, long-time colleagues said. He was among the first group of lawyers who relocated from San Francisco to open the firm’s first Palo Alto office in 1980.

“He really is one of a handful of people who reshaped our firm into what it is today,” said Frederick Muto, chair of Cooley’s business department who’s been with the firm since 1980. “He helped establish us as one of the Valley’s most important law firms. And he was just a great lawyer and a terrific mentor.”

Benton, who helped take Genentech Inc. public in 1980, was considered an expert on securities law, venture capital, mergers and acquisitions and strategic partnering. Thirty years ago, he co-authored a groundbreaking treatise on the legal framework for venture capital financing that’s still used today, colleagues said.

“He was regarded as truly a lawyer’s lawyer,” said Cooley litigation partner Frederick Baron. “He was puckish and brilliant. He was a person of tremendous attention to detail, and clients loved the fact that he turned over every stone to identify and minimize every conceivable risk.”

He was also fiercely committed to helping Cooley grow. As head of the business department and managing partner of the firm, Benton not only helped it become a major player in Silicon Valley. His leadership also helped the firm weather the tough times after the dot-com bubble burst and several high-profile attorneys departed, said James Fulton Jr., co-chair of Cooley’s clean energy and technologies group.

Benton was devoted to both clients and colleagues alike, Fulton said. He was one of the first lawyers at Cooley to take a leave of absence to serve as a general counsel to his clients, such as Santa Clara-based Ungermann-Bass, one of the earliest large computer networking companies.

“He was a beloved counselor,” Fulton said. “People didn’t come to Lee time and again just because he was a good lawyer. So many people who worked with him were personally touched by him. There was his willingness and ability to mentor, on nights, weekends.”

And Benton always made time to help young lawyers, said Wilmer Cutler Pickering Hale and Dorr corporate partner Daniel Zimmermann. Benton began mentoring Zimmerman when he was a young associate at Cooley, and they’ve been friends ever since, he said, sharing practical jokes and conversations over breakfast whenever possible.

“He was someone who always took a difficult situation and turned it into a lesson,” Zimmermann said. “He was just a very kind person who was incredibly meticulous about his work and his relationships.”

A memorial service for Benton will be held Oct. 6 at 1 p.m. at Trinity Church in Menlo Park.

Editorial note: Normally I place many hyperlinks in my posts. I have chosen not to do that for this post, except that I did link the The Recorder article, where I encourage you read the text I copied to this post. I copied the obituaries so that they will be readable for decades, even if the original sources disappear. I hope that the authors of the text I copied do not object. My goal is for this post to endure in its entirety.

AT&T CEO Randall Stephenson is interviewed September 6, 2012 by Rich Lyons, the Dean of the Haas School of Business at University of California Berkeley

Rich Lyons, Dean of the Haas School of Business at UC Berkeley interviews Randall Stephenson, the CEO and Chair off ATT, September 6, 2012. Photograph by Kevin Warnock.

On Thursday, September 6, 2012, I attended the Dean’s Speaker Series at the Haas School of Business at the University of California at Berkeley, in Berkeley, California USA.

This was the first Dean’s Speaker Series I have attended.

I have been aware of this series for years, but I assumed attendance was restricted to friends of the Dean, Rich Lyons, because of the name of the event.

I’ve met and spoken with the Dean about ten times over the years, I estimate, including when he was the Acting Dean when Dean Tom Campbell took a leave of absence to help then Governor Arnold Schwarzenegger manage the finances of the State of California.

Rich Lyons, Dean of the Haas School of Business at University of California Berkeley, asks Randall Stephenson a question, September 6, 2012. Photograph by Kevin Warnock.

A couple of weeks ago I was looking over the Haas website and marveled at the outstanding list of upcoming individuals the Dean will be interviewing on stage. There in front of me were the magic words — the events are open to members of the Haas ‘community.’ I was pretty sure I qualified, since I am a sponsor of one of the school’s premier events, the Berkeley Startup Competition, and have been every year since 2000. I inquired and I got a seat — I was and am thrilled.

The Dean’s guest for this event was Randall Stephenson, the Chief Executive Officer of AT&T, the largest telecommunications company in the United States.

I am an AT&T customer, both for my home’s broadband Internet connection and for my wireless Apple iPhone 3GS, which I bought soon after launch. I no longer have a wired phone. I like AT&T’s service — I get great reception and few dropped calls.

Randall Stephenson, Chair and CEO of AT&T, photographed by Kevin Warnock on September 6, 2012 at UC Berkeley

My regard for AT&T went up after listening to Stephenson speak for an hour. Stephenson was Chief Financial Officer and Chief Operating Officer prior to becoming Chair and CEO, among many roles.

He started at a job he called a ‘tape monkey’ at Southwest Bell Telephone in 1982 loading 19 inch diameter magnetic tapes of billing data onto tape drives. He did this work 12 hours a day — reading a video screen for instruction on which tape to load, finding the tape in storage, loading the tape and then pressing ‘Run.’

I did this same job, though not full time and not for 12 hours a day, when I worked at Cooley LLP. Thankfully I only had to do this role about two weeks a year, when the regular tape technician, Bill Calhoun, went on vacation.

Stephenson said he figured a way to rework his tape loading job to make it much more efficient and enjoyable, though he didn’t tell us the details of what he changed.

Rich Lyons, Dean of the Haas School of Business at University of California Berkeley, listens to Randall Stephenson answer a question, September 6, 2012. Photograph by Kevin Warnock.

During his introductory remarks, Rich Lyons said Stephenson worked in Mexico City as SBC’s Director of Finance.

At some point, Stephenson worked in Mexico for Carlos Slim, the iconic leader of Telmex. Stephenson did not explain how he came to work for Carlos Slim, who presumably was not an SBC employee at any point in his life.

Stephenson said Carlos Slim is ‘the most inherently brilliant individual that I’ve ever worked with.’

Randall Stephenson, CEO and Chair of AT&T, speaks at University of California at Berkeley, September 6, 2012. Photograph by Kevin Warnock.

Stephenson was in Mexico working for Slim in 1994 when there was an economic crisis that began December 19, 1994, when the Mexican government lifted all restraints on the Mexican Peso and let its value float. The Mexican currency lost 40% of its value in one day, Stephenson recalled.

Slim had 20,000 wireless subscribers in 1994, and thanks in part to the aggressive investments Slim made in the aftermath of the economic crisis of 1994, TelMex now has over 200 million wireless subscribers and Slim has made himself reportedly the wealthiest man in the world.

Stephenson took his job as CEO in June 2007 when ATT was a $100B annual revenue company with 300,000 employees, the same month that Apple launched its first iPhone. Stephenson invested heavily when the 2008 financial crisis came.

University of California Berkeley students listen to AT&T CEO and Chair Randall Stephenson speak, September 6, 2012

Stephenson said that 170,000 of AT&T’s employees actively participate in its TIP — The Innovation Pipeline — system conceived by the company’s CTO, a guy so tough to hire that it took ten years for Stephenson to do so. This system allows employees to propose ideas for the company to work on developing. People vote on the ideas and the best ones that float to the top are funded and pursued. In response to a question from a student in the audience, Stephenson said that apart from advertising the program to employees the company does little to promote participation. He said participation is quite good.

University of California Berkeley students listen to AT&T CEO and Chair Randall Stephenson speak, September 6, 2012

Stephenson and and his public relations person Larry (last name not mentioned) said they were so excited about a couple of their ‘tattooed up’ technologists in their Palo Alto, California research lab named the ‘Foundry’ that they put photographs of them in AT&T’s Annual Report. Stephenson divulged that competitors now are ‘coming after’ these programmers trying to hire them away from AT&T.

University of California Berkeley student asks AT&T CEO Randall Stephenson a question about AT&T's TIP suggestion system, September 6, 2012. Photograph by Kevin Warnock.

A student from the audience asked Stephenson to discuss wireless handset subsidies. Stephenson answered at length and concluded that the current system in the United States is overwhelmingly what customers want. He said AT&T performed studies where customers were asked if they would like to finance a phone via a separate finance contract, in exchange for markedly lower rates for service. Stephenson said customers did not like this proposal.

I think the survey respondents that answered this way are short sighted.

The way things operate in the United States, where one can buy a USD $700 iPhone for $200 because of the carrier subsidies, there is a perverse incentive to upgrade your phone exactly every two years. That is because contracts generally run for two years. If you keep a phone for three years, that final year you are paying much more than is warranted for service.

People should be encouraged to save money, not spend, so I admire the relatively new system reported by Stephenson to be the norm in Europe — phones are not subsidized and rates for service are [I hope] commensurately lower. Stephenson said phone sales dropped dramatically when this policy was implemented, but I say that is just what the world needs. People keep a home phone for decades. People keep televisions, stereos and other household appliances for years. Stephenson told me one-on-one after the event that fully 90% of his company’s customers upgrade their wireless phone every 14 months. Since contracts are two years long, 90% of its customers are paying early termination fees, which decline over time. That is a waste of the world’s resources, even in this day of a vibrant resale market for used mobile phones. I’m pretty sure a lot of people just throw their old mobile phones in a drawer, to benefit nobody. I understand mobile phones improve rapidly, and I do plan to get the latest iPhone when it’s available, having skipped the iPhone 4 and iPhone 4s. I just don’t approve of upgrading exceptionally frequently, which I consider 14 months to be.

I encourage AT&T and all carriers to offer unbundled rates for mobile service, as an option.

Rich Lyons is a good interviewer. The setting was photogenic — two handsome cushioned arm chairs on an elevated stage, with a small end table between the chairs. Lyons and Stephenson wore wireless lapel microphones. There was a backdrop behind the men that repeated the logos for UC Berkeley and the Haas School of Business, so the logos made it into every photograph of the people on stage. As a photographer, I applaud the Dean for creating such an inviting, warm and photogenic environment for his interviews. I look forward with enthusiasm to the next Dean’s Speaker Series interview, which I hope to be able to attend.

Former Haas Dean Dr. Laura D’Andrea Tyson is on the Board of Directors of AT&T, and presumably she helped Lyons recruit Stephenson to visit the Haas School. Tyson was Dean when I was a finalist in the Berkeley Business Plan Competition in 1999 with my company Hotpaper.

Student asks AT&T CEO and Chair Randall Stephenson a question about mobile handset subsidies, September 6, 2012, at University of California Berkeley

I took the photographs that accompany this blog post.

I used a Canon 5D Mark II camera with the following lenses: Canon 135mm soft-focus lens set to sharp, Canon 16-35mm L zoom lens. I upload pictures to this blog at maximum camera resolution at maximum image quality. Click on the photographs twice in delayed succession to see the full size images. If you would like to use these pictures, please send me a message. If the purpose is reasonable, I will allow usage. I enjoy having my pictures displayed elsewhere. I pursue photography only as a hobby, not as a profession.

At the end of his interview, Rich Lyons stands with ATT CEO and Chair Randall Stephenson at the Haas School of Business, September 6, 2012. Photograph by Kevin Warnock.

Finally, I have some advice for Berkeley students reading this post — introduce yourself to the speaker.

I don’t recall seeing any students introduce themselves to Stephenson. I did see a professor and a president of a good sized company say hello, but that’s it. Stephenson spent several minutes talking with me because there was nobody waiting after me to speak with him. The room had rapidly cleared out. The interview was during the lunch hour, so perhaps the students had to be in class immediately after. It’s rare for so prominent a CEO to speak to such a small group — there were about 140 students in the room by my quick count. I’m sure Stephenson won’t be back this academic year. Make a point of meeting all such prominent speakers. In my mind, Stephenson should have been surrounded by dozens of students trying to shake his hand. Stephenson didn’t appear to be in a rush to depart, and I left before he did.

Peet’s Coffee & Tea, Inc. (NASDAQ: PEET) to be aquired for approximately USD $1,000,000,000

I just learned that Peet’s Coffee & Tea is to be acquired for about a billion US dollars.

Wow!

I feel a modest connection to this news because I used to date a barista that worked at the 3419 California Street branch of Peet’s Coffee in San Francisco.

I have lost touch with Muire Dougherty, but this news that Peet’s will soon be acquired for a cool billion dollars made me think of her, and the positive influence that she had on my life.

Cooley LLP does legal work for Peet’s Coffee.

I used to work at Cooley while I was dating Dougherty. I don’t know if Cooley represented Peet’s back then or not.

I learned about this pending acquisition from Cooley’s Facebook status update. The update was brief, so I don’t know if Cooley advised Peet’s on this transaction, but knowing what I know of Cooley, they likely did.

Here’s the Peet’s press release, for posterity:

Peet’s Coffee & Tea, Inc. to Be Acquired by Joh. A. Benckiser for $73.50 Per Share in Cash

Peet’s to Become Private in a Transaction Valued at $1 Billion

EMERYVILLE, Calif.–(BUSINESS WIRE)– Peet’s Coffee & Tea, Inc. (NASDAQ: PEET) and Joh. A. Benckiser (“JAB”) today announced that they have entered into a definitive agreement under which JAB will acquire Peet’s for $73.50 per share in cash, or a total of approximately $1 billion. The agreement, which has been unanimously approved by the Peet’s Board of Directors, represents a premium of approximately 29% over Peet’s closing stock price on July 20, 2012.

At the close of the transaction, Peet’s will be privately owned and will continue to be operated by the company’s current management team and employees. Peet’s Coffee & Tea, founded in Berkeley, CA in 1966 by Alfred Peet, will remain based in the San Francisco Bay Area, with its home office in Emeryville and its LEED® (Leadership in Energy and Environmental Design) Gold Certified roast-to-order facility in Alameda.

“We are very excited about this next chapter in Peet’s rich history,” said Patrick O’Dea, President and CEO of Peet’s. “Over many years we’ve demonstrated an unyielding commitment to craft coffees and teas of uncompromised quality. This commitment is what has distinguished the Peet’s brand among all others and will continue to guide us as we go forward.”

Jean-Michel Valette, Chairman of the Board of Peet’s, added, “In my experience it is rare to find a company and a brand as special as Peet’s. We are pleased that JAB recognizes this and that Peet’s existing shareholders will be rewarded with significant value.”

“At JAB, we are committed to owning and investing in companies with strong, premier-quality brands and great people whose values we share,” said Bart Becht, Chairman of JAB. “Peet’s is just such a company and we look forward to preserving the company’s culture and core values, while supporting management’s vision for future growth.”

In addition to JAB, BDT Capital, a Chicago-based merchant bank that provides long-term private capital and advice to closely held companies, is participating in this transaction as an advisor and minority investor.

The transaction, which is structured as a one-step merger with Peet’s as the surviving corporation, is not subject to a financing condition and is expected to close in approximately three months, subject to customary closing conditions, including receipt of shareholder and regulatory approvals. The transaction requires the affirmative vote of holders of a majority of the company’s outstanding shares, which will be sought at a special meeting of shareholders.

Citigroup is serving as exclusive financial advisor to Peet’s in connection with this transaction and has delivered a fairness opinion to the Board of Directors of Peet’s. Cooley LLP is acting as Peet’s legal advisor. Skadden, Arps, Slate, Meagher & Flom LLP is acting as legal advisor to JAB in this transaction. Morgan Stanley & Co. LLC and BDT & Company are serving as financial advisors to JAB.

In light of today’s announcement, Peet’s will not be holding a conference call to discuss its second quarter fiscal 2012 results.

About Peet’s

Peet’s Coffee & Tea, Inc. (NASDAQ: PEET) is the premier specialty coffee and tea company in the United States. The company was founded in 1966 in Berkeley, Calif. by Alfred Peet. Peet was an early tea authority who later became widely recognized as the grandfather of specialty coffee in the U.S. Today, Peet’s Coffee & Tea offers superior quality coffees and teas in multiple forms, by sourcing the best quality coffee beans and tea leaves in the world, adhering to strict high-quality and taste standards, and controlling product quality through its unique direct store delivery selling and merchandising system. Peet’s is committed to strategically growing its business through many channels while maintaining the extraordinary quality of its coffees and teas. For more information about Peet’s Coffee & Tea, Inc., visit www.peets.com.

About Joh. A. Benckiser

Joh. A. Benckiser is a privately held group focused on long term investments in premium brands in the broader consumer goods category. The group’s portfolio includes a majority stake in Coty Inc., a global leader in beauty, a minority stake in Reckitt Benckiser Group PLC, a global leader in health, hygiene and home products, and a minority investment in D.E Master Blenders 1753. The group also owns Labelux, a luxury goods company with brands such as Jimmy Choo, Bally and Belstaff. The assets of the group are overseen by three senior partners: Peter Harf, Bart Becht and Olivier Goudet.

About BDT Capital Partners

BDT Capital Partners provides family-owned and entrepreneurially led companies with long-term capital, solutions-based advice and access to an extensive network of world-class family businesses. Based in Chicago, BDT Capital Partners is a merchant bank structured to provide advice and capital that address the unique needs of closely held businesses. The firm has a $3 billion investment fund as well as an investor base with the ability to co-invest significant additional capital. Through its advisory business, BDT & Company works with family businesses to pursue their long-term strategic and financial objectives.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements. Statements that are not historical facts, including statements about beliefs or expectations, are forward-looking statements. These statements are based on plans, estimates and projections at the time Peet’s makes the statements, and readers should not place undue reliance on them. In some cases, readers can identify forward-looking statements by the use of forward-looking terms such as “may,” “will,” “should, “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other comparable terms. Forward-looking statements involve inherent risks and uncertainties, and the Company cautions readers that a number of important factors could cause actual results to differ materially from those contained in any such forward-looking statement. Factors that could cause actual results to differ materially from those described in this press release include, among others: uncertainties as to the timing of the acquisition; the possibility that competing offers will be made; the possibility that various closing conditions for the acquisition may not be satisfied or waived, including that a governmental entity may prohibit or refuse to grant approval for the consummation of the acquisition; general economic and business conditions; and other factors. Additional risks are described in the Company’s Annual Report on Form 10-K for the year ended January 1, 2012 and its subsequently filed reports with the Securities and Exchange Commission (“SEC”). Readers are cautioned not to place undue reliance on the forward-looking statements included in this press release, which speak only as of the date hereof. The Company does not undertake to update any of these statements in light of new information or future events.

Additional Information and Where to Find It

In connection with the proposed merger, Peet’s Coffee & Tea, Inc. will prepare a proxy statement to be filed with the SEC. When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE PROPOSED MERGER BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. The Company’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website at http://www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to Peet’s, 1400 Park Avenue, Emeryville, CA 94608, attention: Investor Relations or by calling (510) 594-2100.

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders with respect to the proposed merger. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s 2012 Annual Meeting of Shareholders, which was filed with the SEC on April 2, 2012 and will be set forth in the proxy statement regarding the proposed merger. Shareholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the proposed merger, which may be different than those of the Company’s shareholders generally, by reading the proxy statement and other relevant documents regarding the proposed merger, when filed with the SEC.

Peet’s Media Contacts:

Sard Verbinnen & Co

Paul Kranhold, 415-618-8750

pkranhold@sardverb.com

John Christiansen, 415-618-8750

jchristiansen@sardverb.com

or

Peet’s Investor Contact:

Seanna Allen, 510-594-2196

investorrelations@peets.com

or

JAB Media Contacts:

Abernathy MacGregor Group

Chuck Burgess, 212-371-5999

clb@abmac.com

Tom Johnson, 212-371-5999

tbj@abmac.com

or

BDT Capital Partners Media Contact:

Jennifer Dunne, 312-660-7314

jdunne@bdtcap.com

Source: Peet’s Coffee & Tea, Inc.

News Provided by Acquire Media

—————–

(Disclosure: Cooley is legal counsel to my current Internet company.)

Have an MBA and an idea? Looking for a technical co-founder to build it and join your unfunded startup for equity alone?

One of my highlights each month is serving as a mentor for the Haas Founders group.

Haas Founders is a group for Haas School of Business graduates from the University of California at Berkeley. It’s an invitation only group, but if you graduated from Haas you are quite likely to receive an invitation if you are a founder or co-founder of a startup company.

Another way in is to have a meaningful connection to the Haas School. That’s how I became a member. I have been a judge for the Berkeley Startup Competition from about 2004 through 2011.

Finally, all Haas graduates can buy their way in by agreeing to pay for the food and drinks. This allows service providers like bankers, investors and accountants to attend. Such service providers can meet ambitious startup founders that sometimes turn into clients.

I write the above to introduce you to the Haas Founders meeting. There is a Facebook page and a Twitter account for Haas Founders. Michael Berolzheimer moderates and organizes the Haas Founders meetings. Berolzheimer runs the genesis-stage venture firm Bee Partners which, according to his firm’s web site, pollinates visionary entrepreneurs with financial, human and social capital. Kishore Lakshminarayanan helps Berolzheimer set up the meetings, which take place at different venues each month, in the East Bay, South Bay and San Francisco, California USA. I met Berolzheimer in 2007, before he took on the responsibility for Haas Founders from the previous organizer, Mat Fogarty, CEO of Crowdcast.

Haas Founders has established a group on the professional social networking site Linked In. As of this morning there are 86 members. I believe the group is seeking new members, so if you fit the requirements, please introduce yourself to Michael Berolzheimer.

Haas Founders can be thought of as a board of directors like support group for startup founders, where no issues are off limits for discussion. That makes Haas Founders one of the most compelling meetings I’ve had the good fortune to attend.

I have attended the Haas Founders meetings since about 2005. Individual meetings are limited to 20 attendees.

This open forum for frank talk is made possible because attendees are asked to keep the the conversations confidential. To my knowledge, there has never been a meaningful breach of this rule. I think that’s a reflection of the trustworthiness and integrity of Haas students and graduates.

Given this secrecy, how can I write a blog post about Haas Founders?

Well, I am not going to discuss confidential information. The advice I am going to give is my own. I gave this advice to a participant at the most recent meeting March 6, 2012 in San Francisco.

I am not breaking confidentiality by repeating what I said that day because I have given this same advice many times without any restriction of confidentiality. It’s already public information. Problem averted. I ran this post by Berolzheimer before publishing it, as I want to be extra careful so as to not be uninvited to future meetings.

I decided to write this post because the issue I am going to talk about comes up so frequently that I have spent hours and hours answering this question over the years.

The question and answer are as follows:

Q: I am a non-technical founder and I have thought of a business idea that requires something technical be built. How do I find a talented technical co-founder to join my company for equity only to build my vision for me?

A: Forget it!

You can’t find a talented technical co-founder to join your unfunded idea stage company for equity only.

There are rare exceptions, but you can not count on them and should not consider counting on them.

One solution is to think of and pursue a business idea that you can implement with only the skills you have already. Here are three companies that I suspect began with little computer programming, for example:

- Become a mushroom farmer.

- Start a fair trade import company.

- Start a men’s fashion manufacturing company.

The smart people I suggest this answer to don’t quickly embrace my advice. That’s understandable. They are in love with their vision and they want to pursue that vision right now. They don’t want to hunt for a technically simpler business idea. They don’t want to learn the technical skills necessary to develop their original idea. They want a savior, a Steve Wozniak, to fall from the sky to do the real work of making a viable product. Usually such non-technical founders also want to reserve more of the company equity for themselves than for this savior, because they thought of the idea. If there is to be an equity disparity, I suggest it be weighted toward the technical contributors who make the product happen, not the non-technical people who think up the idea.

What non technical founders fail to appreciate is that talented technical individuals with the grit to want to start a company are in high demand. They are like supermodels in their desireability. A lot of people are asking them for dates. A lot of these suitors have lots of money to woo them with.

Why would a supermodel date a founder with no money when there is a line of suitors with six, seven or eight figure stacks of money at their side ready to spend?

The answer is supermodels don’t date broke founders.

Supermodels don’t hook up with unfunded MBAs that have a cool idea.

The perhaps sad truth is that MBAs are not held in high regard by many technical experts. This is not a comment on Berkeley MBAs, but on all MBAs. Of course, technical experts desperately need business experts at some point, as exits are rare for companies filled with only technical experts. I am not taking a stand on which type of person is more valuable because they are both vital. What I am saying is the technical people generally perceive that MBAs are not that important. If that’s the perception, then how can an MBA recruit a technical person without money?

There are millions of cool ideas to pursue at any moment. That’s always been the case and that will always be the case.

Talented technical people know they are in demand. They have recruiters calling them telling them so all the time. They read TechCrunch, VentureBeat and GigaOm. They know the technology world is in the middle of a full fledged boom right now. So only 2nd, 3rd, 4th and 5th rate technical people will agree to an equity only founder position with a non-technical sole co-founder.

The only practical exception is if you’ve already been friends with the person for years and they know your work and respect it. So classmates graduating together can get together and start a company, with some founders being non technical and some being technical.

But if you’re looking for a stranger to drop out of the sky to build your vision, you should forget it and focus on finding a simpler idea or on learning the technical skills yourself so you can build the first version of the product by yourself.

Yes, the product won’t likely have to polish of one created by a more seasoned expert, but it can be good enough. You only need it to be good enough to raise money that you can then use to pay a more skilled technical person to make an improved version.

I am not spouting off advice I read somewhere or heard somewhere — I know what I am talking about. Pardon me while I now go into extreme detail to convince you that I do know what I am talking about. What follows may seem like too much, but I have spent dozens and dozens of hours trying to beat this lesson into the heads of very smart non-technical company founders. I feel I need to pull out all the stops here to convince the skeptical that I am right.

I know it’s smart to learn to program because this is what I did to take my startup Hotpaper.com, Inc. from a USD $10,000 investment when I had almost no applicable skills through to a USD $10,000,000+ sale to a public company just six years later.

This is news I’ve written about more than once. But I haven’t described the grueling early work I put in that made this ‘quick success’ possible.

When I started Hotpaper, I was a minicomputer programmer. A Digital Equipment Coporation VAX minicomputer running Open VMS. There was nothing miniature about this computer. It filled an entire raised-floor water-cooled computer room and served 1,000 users in five offices in two US states. I believe it cost more than USD $12,000,000. Back then a 9 gigabyte disk drive cost USD $250,000. I saw the invoices and recall calculating the price per gigabyte.

When I started Hotpaper my only experience programming a PC was writing rudimentary DOS batch files. One can still write these for Windows, to run at a command window prompt. You can do amazing things with batch files, but you can’t write serious client-server or web applications with them. I had to learn to program graphical Microsoft Windows applications, and I had only used DOS on a PC up until that point. I had played for a few hours with a copy of Windows 3.1, but that was the extent of my experience with Windows. The one machine my employer had that ran Windows was so slow (Intel 386 with perhaps 1 megabyte of memory) that when you pressed a letter in a word processor (Ami Pro), there was a lag of about 1 full second before the character would show up on screen. It was pathetic.

I immediately bought a Hewlett Packard Pentium 60 Mhz computer with 4 megabytes of RAM and Windows 3.1 for Workgroups. I added Microsoft Office, which came on 30+ 3 1/2″ floppy disks, not a CD-ROM. This was a Pentium, not a Pentium II, III or IV. In fact, it was the slowest Pentium chip ever sold. But this was the fastest computer I had ever used. I still have it, in storage.

I all but shut myself off from the world for two years with hundreds of dollars of technical books, a 28.8K modem and a telephone. I taught myself to be an event driven computer programmer. Event driven programming is much different from the procedural programming I had done to program the huge VAX system run by my employer at the time, Cooley LLP. Yes, I knew how to program a little bit on a VAX, but Windows is so different that it’s almost as if I was learning to program from scratch.

Thankfully, Microsoft was not yet the market leader in word processing in 1994 since WordPerfect for DOS still dominated, so Microsoft tried very hard to persuade developers to embrace their Word word processing software. They offered free telephone technical support for programming problems, provided you paid for the phone call. There were no unlimited business phone lines back then, so my office phone bill was perhaps USD $100 a month due to all my calls to Microsoft — hours and hours of calls per month. I owe Microsoft so much for those calls, as they helped me to solve every problem I ever encountered. Thank you Microsoft.

Eventually Microsoft overnight switched from free technical support calls to USD $55.00 per incident technical support calls, and I had to stop calling them. But that was a couple of years later, and I had already gotten to be proficient by then, and I could get my questions answered for free on their well run newsgroups. By that point, Word and Office were the market leaders, and they didn’t need to try so hard to make developers embrace their tools.

I worked hard — really, really hard. I worked from about 10am to 10pm Monday through Saturday. On Sunday I wouldn’t come into the office until the mid afternoon, but I would still stay until 10pm or so. I did this from January 1995 through the end of 1996 or so, I believe. It took me that long to learn Windows programming reasonably well.

I didn’t know other software developers. There were no popular coworking spaces. Meetup didn’t exist. I was shy. But I was driven… really, powerfully and passionately driven. I had so little money I was living in a tiny studio apartment on Mason Street near Bush Street in San Francisco, California USA. My rent was USD $625 a month including utilities. I only owned one computer, so I could not work at home. I was at the office a lot, and it was just a seven minute walk to get there. I became really good friends with my office mates the late Stan Pasternak and patent attorney Robert Hill. I have such fond memories of that time.

Was the code I produced great? No. Was it awful? No. Was it reliable? Yes. Was it understandable to others? Yes. Did it get used by others for meaningful projects? Yes. Did I raise money with it? Yes. Did I sell the company successfully by following this model? Yes. Can you do the same? I think so.

At Hotpaper, I had a customer from the day I bought a computer. I told them I could build what they asked for. I actually had never done so on Windows. I had to figure out how to program Windows because I had a paying customer that demanded a Windows client-server based solution. They were paying me thousands so I had to deliver. I didn’t study for two years and then start to look for a client. I got the client based on my past reputation as a VAX programmer and then faked it until I made it.

It turns out that first project failed and the client never used my work or the work of any custom software developer.

They just bought an off the shelf application and conformed to its way of doing things.

But that’s irrelevant in the end. I got paid USD $30,000. I worked hard. The client made the best decision, for they should never have hired me or any developer when an off the shelf package was available for much less than having custom software written. I learned a lot, kept the rights to what I had built but did not get used, and I used that for the basis for what I then turned around and sold to Coca-Cola and the United States Department of Commerce, where it did get used on an enterprise scale.

Today it’s easier than ever to become a programmer. There are so many online tutorials like those from Codecademy. There are so many hacker co-working spaces like Hacker Dojo where you can base your new venture. You can work there as many hours as you can keep your eyes open, and there are smart people around much of the time to get help from.

Today all the software you need to do almost any project is free. That wasn’t the case in 1995, when now standard building blocks like MySQL hadn’t been popularized yet.

I have seen smart graduates spin their wheels for months or years trying to recruit a magical co-founder to build their product. How much better it would be for these people to sit down at Hacker Dojo and focus their considerable brain power on learning to program software directly. Even if the entire result is eventually rewritten later by someone more skilled, they would be better off than if they somehow found the mythical co-founder.

For once you know how to program in any language, you will be able to talk about and think about technical problems far more effectively than you can as a non programmer. It will be far more difficult for people to confuse, mislead or bamboozle you. You will be able to hire better programmers who will respect you more. You will be able to tell programmers what to attempt with more clarity and conviction because you know at least something about their world.

You will have insight into a world that’s richly diverse and totally fascinating. Your life will improve even if you never make a penny from your venture.

Programming is not easy. It can be absurdly complicated and exasperating at times. That’s why new college graduates who know little about the real world of programming can still command pay approaching USD $100,000 to start.

I am just one modestly successful entrepreneur.

Before you become a programmer, ask some technical startup founders you trust and see if they agree with what I’ve written here. Remember, Steve Jobs got lucky with Steve Wozniak. Silicon Valley was a sleepy place back then compared to today. Go make your own luck by developing your technical skills. If you have an MBA, you presumably spent four years to get an undergraduate degree and two years to get a business degree. Spend two more years to become a programmer. Doctors spend more time studying before they complete their education, so view eight years of study as normal, not crazy or silly.

I love programming, and I am extremely grateful I spent those grueling early years just powering through the books and road blocks to learn to program.

I feel I can do nearly anything I can dream up.

That’s a powerful feeling I wouldn’t give up for anything.

Please subscribe to this blog by leaving your email address in the upper right corner. Please friend or subscribe to me on Facebook. Please follow me on Twitter.

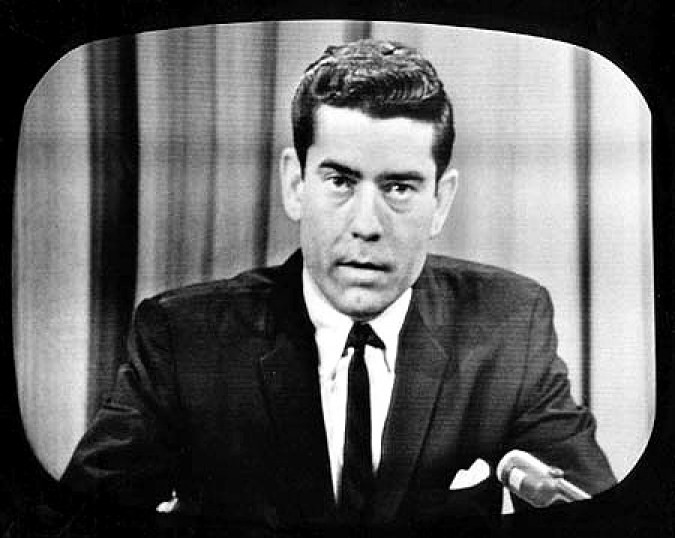

Dan Rather’s big break

I’ve been a fan of Dan Rather for years. Today I came across a great video interview of Rather where he tells how he got his break into television news in New York working for CBS News.

It’s a great story.

Dan Rather in 1960 was working as the News Director at KHOU television, a station Rather says in the video below was at the time the fifth or sixth station in a three station [television] market in Houston, Texas.

Dan Rather grew up in Texas in hurricane country and had had a life long fascination with hurricanes, perhaps from being born in Wharton, Texas on the Texas coast.

When he saw in September 1961 reports of what appeared to be an extremely large hurricane heading towards the Gulf of Mexico, he convinced his skeptical Program Manager Cal Jones that he should go to Galveston, Texas to cover the pending disaster, named hurricane Carla. Although Rather was not a meteorologist, he predicted accurately that the hurricane, which reached a level 5, would hit Galveston. Rather argued that Galveston would be flooded and inaccessible once the hurricane hit, so he had to go there immediately. His boss reluctantly gave Rather and a television cameraman the permission to go there.

This was the first time that a hurricane had been covered live on television.

Rather was correct — the huge hurricane hit and no other television news crew was in Galveston. Rather’s live coverage, including live radar screen video with a clear plastic map of the Texas coastline on top of the radar screen, was so compelling that the National CBS News producers picked up the feed from KHOU TV. The National CBS signal was fed throughout the United States, putting Dan Rather on a big stage at the center of a big news story, as the hurricane was monstrous in size and sadly killed 43 people despite 500,000 people being evacuated.

When Rather returned to his little television news department where he was the only full time employee, the bosses at CBS News headquarters called and offered Rather a job in New York. Dan Rather accepted a job as a television news correspondent, and his path toward anchoring the CBS nightly news became more probable.

This story should provide insight for everyone with big aspirations in life.

For the most part, people make their own luck.

I think Dan Rather made his own luck in this case. He turned his personal interest in hurricanes into his big break. He recognized the advantage to being the only reporter at the scene of a very big story. He persuaded his skeptical boss at the time, who knew nothing about hurricanes, to send him into the danger zone. He performed well under pressure, and when approached by the bosses at CBS News headquarters, he apparently had the political skill to turn their interest into a job. Finally, he had the good sense to leave his job as News Director to become Correspondent, even though Correspondent was a huge reduction in title.

Sitting around waiting for your lucky break is unproductive.

Go make your own luck like Dan Rather did.

Although my success pales in comparison, I followed much the same formula when I turned getting fired from Cooley LLP into selling my response to that firing for an extremely low eight figures just six years later. I could have fallen into a depression and plodded through life upset that Cooley didn’t want my expertise despite the positive press coverage my work had been receiving. Instead, I worked hard to expand and perfect my expertise. I packaged up my expertise into an attractive package called a corporation, and sold it when a buyer was buying, despite that being uncool at the time. I did all this with determination and purpose, and predicted accurately that I would sell as soon as soon as it became practical. I became an angel investor and advisor to startups, while also starting a third company, which I continue to work on.

I am remaking myself in similar fashion right now after an even more debilitating setback than being fired, and I predict that I will show even more success this time around. Why? Because I am more confident, wise, connected and savvy than I was when I started my first company at age 23 and my second company at age 30.

I used to be so shy, a huge impediment to entrepreneurial success. Now I can strike up a conversation with anyone, anywhere — even on the bus, at a club or in line at the bank. I sure wish I could have done this when I was 18, for my life would have been much better. But I am thankful that I can do it now. If you can’t do this now, make it your mission to figure it out as soon as possible, even if you have to hire a coach and practice at great pain to yourself. It’s simply not that hard once you practice a little bit and leave your fear at the door. I haven’t had one bad experience starting a conversation. There are few skills more important than being able to confidently approach and strike up an enjoyable conversation with anyone, no matter what you want to do in life.

Zimman’s sells sumptuous fabrics at fair prices

Fabric for sale at Zimman's of Lynn, Massachusetts, USA. Picture from http://nshoremag.com/zimmans-of-lynn/

The last time I worked for others, I worked for Jeff Zimman, Susan Philpot and Hank Barry.

I was at Cooley, LLP, a powerhouse law firm in Silicon Valley.

Zimman chaired the Document Automation Committee at Cooley, the entity to which I reported in my role as Computer Aided Lawyering Project Leader.

Jeff Zimman is currently the Chair of Posit Science, Inc., which produces software to help build and maintain cognitive function. Listeners to KQED public radio in the San Francisco Bay Area, where I live, are familiar with Posit Science because this software is always one of the gifts one may select if one becomes a financial sponsor of that radio station. I love KQED, by the way, and I listen to it almost every day. You may sponsor KQED online at this link.

Even though I have known Zimman for a majority of my professional life, I know little about him as a person. I know the basics – that he’s married to architect Ken Ruebush, the brother of my friend Susan Ruebush. I know Jeff Zimman used to be an investment banker at Lazard before co-founding Posit Science. I know Jeff Zimman used to be a newspaper reporter before he went to law school.

Thanks to Facebook, a currently well known social networking website based in Silicon Valley, I now know something new about Jeff Zimman.

Jeff Zimman’s grandfather Morris Zimman 103 years ago founded a treasure of a retail store named Zimman’s. This store is so lush, sumptuous and glorious that articles have been written about it. Gushing articles so colorful that they make one want to make a special trip to Zimman’s just wander the isles and touch the products.

What does Zimman’s sell? Here’s how their website explains it:

“Zimman’s offers one of the largest selections of decorative fabrics and passementerie, combined with a wonderful assortment of premium furnishings, exquisite accessories, lighting, rugs and custom products.

Located in Lynn, Massachusetts, Zimman’s is the country’s leading fine fabric, furniture, lighting and decorative accessories destination.”

Before today, I had never heard the word passementerie. This is what WikipediA has to say initially about passementerie:

“Passementerie or passementarie is the art of making elaborate trimmings or edgings (in French, passements) of applied braid, gold or silver cord, embroidery, colored silk, or beads for clothing or furnishings.

Styles of passementerie include the tassel, fringes (applied, as opposed to integral), ornamental cords, galloons, pompons, rosettes, and gimps as other forms. Tassels, pompons, and rosettes are point ornaments, and the others are linear ornaments.”

Zimman’s sells fabric.

Perhaps the nicest fabric I have ever seen — have a look at the photograph above.

The only store I can compare it to in the Bay Area is Britex Fabrics. But Britex is a premium priced emporium located in costly Union Square retail space. Prices at Britex are sky high such that it’s a turnoff to even browse.

Zimman’s by choice is located next to a 99-cent discount store, so their rent is affordable. The savings are passed on to customers, which results in Zimman’s being both affordable and magical at the same time.

It’s as if Neiman Marcus moved into a Costco and reused the same shelving to sells its luxury goods. Prices could drop dramatically if they didn’t have to support the exceptionally luxurious stores that they’re famous for.

Here’s what Michael Zimman, Jeff Zimman’s brother, has to say about the store he now rus:

“It’s an unlikely spot for this type of business to evolve,” agrees owner Michael Zimman, grandson of the store’s founder, Morris Zimman. “But it works for us. You need a lot of space, which we have, and we’ve been doing it for 103 years, so we’ve developed a broad reputation.”

“With arguably the largest selection of textiles on the East Coast, if not in the country, and a carefully curated array of furniture and decorative items, Zimman’s has become a destination business, surviving the changing landscape of retail by smart specialization and unbeatable prices.

Stepping into Zimman’s can be a daunting proposition. With about 40,000 square feet—nearly an acre—of shopping spread over three floors, some customers, especially those seeking textiles, may not know where to start. After all, Zimman’s has at least 25,000 bolts of fabric in house—but who’s counting? “It might be 50,000. It might be 100,000. We don’t stop to count,” Michael Zimman says. “But that’s part of what makes us unique. We’re for people who want to step back into the way things were and have an experience of shopping in an emporium, putting their hands on textiles and furniture… It’s a throwback, and people really love it.””

I do wonder after reading Coffey’s article if Jeff Zimman also spent a lot of time at Zimman’s while he was growing up, like his brother Michael did. Coffey writes:

“Zimman’s dedication to the old ways has deep roots; Michael learned the business at his grandfather Morris Zimman’s knee. Morris opened the store in 1909, and Michael says he cannot remember a time when he wasn’t involved in the business. In fact, if he wanted to see his father, who worked from 10 a.m. until 10 p.m. six days a week, he had to go to the store. While in the second grade, Michael would take the bus from the family’s home in Marblehead to swim at the Boys’ Club on Lynn Commons. After swimming, Zimman would wend his way through back alleys and residential neighborhoods in the waning afternoon light to get to his father’s store for a ride home.”

It is highly unusual for a lawyer to found a company. Jeff Zimman is certainly an entrepreneur. Posit Science is not an easy kind of company to start. They raised tens of millions of dollars in venture capital. They have world renowned scientists like Michael M. Merzenich, PhD on the team (see Merzenich’s extensive WikiPediA entry here). What Jeff Zimman has accomplished makes my head spin compared to what I have done in the software field.

I suspect that it is extremely likely that Jeff Zimman was profoundly influenced by his grandfather Morris Zimman, the founder of Zimman’s. Watching his grandfather build and operate a successful business had to help inspire him to leave the relative tranquility of lawyering and banking to become a startup founder. I run into Zimman only about yearly, but I will ask him about this connection the next time I see him.

Finally, a fun fact near to my heart — Zimman’s used to advertise on the sides of city transit buses. There is an animated graphic that plays as soon as you arrive at the Zimman’s website that shows the bus ‘driving’ from right to left across the top of the website. I was able to capture the bus in a screen shot after a few tries with Snag It screen capture software. Here is the result. As my readers know, I am a huge fan of buses, and I own a bus even larger than the one below, although now it’s a motorhome.

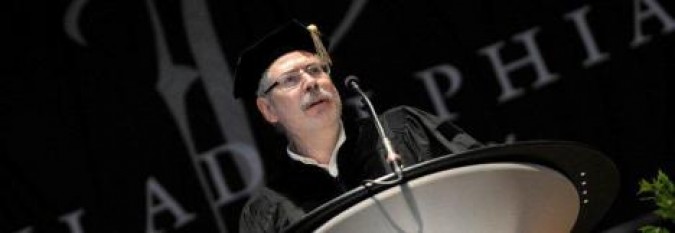

Steve Blank’s Philadelphia University commencement address

Here is the best commencement address I have ever heard or read. It’s by Steve Blank. I’ve written about Steve Blank and his writing before.

I consider his Four Steps to the Epiphany book to be the most important book for entrepreneurs to read.

Blank gave this speech May 15, 2011 at the commencement for Philadelphia University.

Here’s one story from the speech that particularly resonates with me. When Blank was a young man he was in the United States military. He volunteered to go to Thailand and he kept volunteering once he got there. His enthusiasm and curiosity paid off, as you’ll see:

“Once again, I was going to see where the road would take me. Volunteering for the unknown…which meant leaving the security of what I knew…would continually change my life.

Two weeks later I was lugging heavy boxes across the runway under the broiling Thailand sun. My job was to replace failed electronic warfare equipment in fighter planes as they returned from bombing missions over North Vietnam.

As I faced yet another 110-degree day, I did consider that perhaps my decision to leave Miami might have been a bit hasty. Yet every day I would ask, “Where does our equipment come from… and how do we know it’s protecting our airplanes?”

The answer I got was, “Don’t you know there’s a war on? Shut up and keep doing what you’re told.”

Still I was forever curious. At times continually asking questions got me in trouble…

once it almost sent me to jail…

but mostly it made me smarter.

I wanted to know more. I had found something I loved to do.. …and I wanted to get better at it.

When my shift on the flightline was over, my friends would go downtown drinking. Instead, I’d often head into the shop and volunteer to help repair broken jammers and receivers. Eventually, the shop chief who ran this 150-person shop approached me and asked, “You’re really interested in this stuff, aren’t you?” He listened to me babble for a while, and then walked me to a stack of broken electronic equipment and challenged me troubleshoot and fix them.

Hours later when I was finished, he looked at my work and told me, “We need another pair of hands repairing this equipment. As of tomorrow you no longer work on the flightline.” He had just given me a small part of the electronic warfare shop to run.

People talk about getting lucky breaks in their careers. I’m living proof that the “lucky breaks” theory is simply wrong. You get to make your own luck. 80% of success in your career will come from just showing up. The world is run by those who show up…not those who wait to be asked.

Eighteen months after arriving in Thailand, I was managing a group of 15 electronics technicians.

I had just turned 20 years old.”

I think most success people have is the result of them doing more than is expected, and I admire Blank for selecting such a concrete example from his past to illustrate this point.

While I’m mentioning important books, the book I consider the second most important for entrepreneurs to read is The Entrepreneurs Guide to Business Law, by Craig E. Dauchy and Constance E. Bagley. I used to work with Dauchy at Cooley LLP. He’s one of the most respected members of that firm, so I place a lot of faith in what this book has to say.

Micheal Traynor was really nice to me

I just read a nice tribute to Michael Traynor, an attorney I was friends with when I worked at Cooley LLP years ago. I haven’t thought much about Traynor since I left Cooley in 1994, but today I was reviewing profiles on Wikipedia, the online encyclopedia, looking for entries about people I know personally.

Traynor’s father Roger Traynor has a Wikipedia entry, and Micheal is mentioned in that entry. I knew Traynor was an important attorney when I was at Cooley, but I don’t think I realized that his father had been Chief Justice of the California Supreme Court from 1964-1970.

Micheal Traynor was extremely nice to me. His office was about 40 feet from my first office at Cooley, on the 20th floor of One Maritime Plaza in San Francisco, California. Later, I moved to the 19th floor.

Traynor was aware of the political storms I navigated before I prevailed and got a special promotion and an attendant committee of partners to report to. He offered multiple times to intervene on my behalf with the powers in charge. I never took him up on his offer, as I had others like Tony Gilbert helping me and it didn’t seem kind to involve Traynor.

I knew Traynor for almost five years, and he would always say hello to me, and I always felt like he was my friend and that he approved of the work I was passionate about at Cooley, which was encoding the expertise of lawyers into document assembly software so that less experienced attorneys could create documents that incorporated Cooley’s best thinking on a topic.

Until today I didn’t know Traynor was president of the American Law Institute.

I’m not surprised.

Cooley LLP law firm 2010 annual review report released

I just got an email that noted the Cooley LLP 2010 annual review report is ready for downloading.

I worked at Cooley LLP for about five years, so I looked through the report, marveling at the scope of projects that law firm works on.

I’ve written about Cooley before, so you know I like this firm.

I recommend Cooley to my friends running companies.

When I was looking for a job 3 years out of college, I had never heard of Cooley (then Cooley Godward Castro Huddleson & Tatum). I just got supremely lucky to get hired by such a quality firm.

My advice to new college graduates:

Select your employers carefully since you may remain connected to them forever.

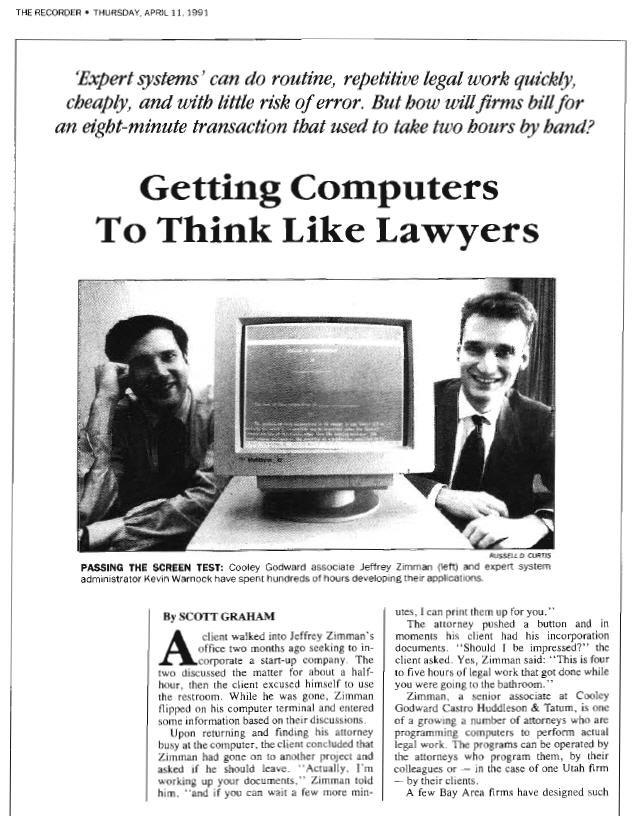

It was 20 years ago today that I got my picture in The Recorder while I worked at Cooley LLP

Twenty years ago today I was working on Cooley LLP’s document assembly software development effort.

On this day April 11th in 1991, the project was featured in a lengthy article in The Recorder, a San Francisco newspaper for the legal profession. Here’s the PDF scan I made from the paper copy of the article I’ve saved for the last two decades: Getting Computers To Think Like Lawyers – The Recorder – April 11, 1991.

That was a big day for me, as non lawyers at law firms almost never receive any attention from the press. It was also a big day for my project because Kenn Guernsey, Cooley’s Managing Partner at the time, left Jeff Zimman and me a nice voicemail congratulating us for our work. Zimman was the attorney that got the project off the ground by personally programming Cooley’s first document set, and without him, I wouldn’t have likely started Hotpaper.com, Inc. or later created the first online office suite, gOffice. Hotpaper was the first online document assembly application. The application was live on the Internet in 1997, two years before I changed the name of the company from Document Automation Systems LLC to Hotpaper.com, Inc. I licensed this online document assembly software to 30 of the Fortune 500, which I was proud of given my company at the time consisted of just me.

I run into Zimman on the San Francisco MUNI every year or so. He made partner at Cooley in six years I believe, and later became an investment banker at Lazard Ltd. Now he is Chair of Posit Science, which makes computer software that helps improve mental functions. It’s really interesting to me that we both became entrepreneurs after our stints at Cooley.